Who the heck's Ken Cooper? I'd have more confidence in the late Tommy Cooper or Conway Twitty.

Its all only make believe!!!!!

Still no sign of the facts!!!!!!!!

Its all only make believe!!!!!

Still no sign of the facts!!!!!!!!

Re: Who do you believe? Thu Jan 27 2022, 16:09

Re: Who do you believe? Thu Jan 27 2022, 16:09

Re: Who do you believe? Thu Jan 27 2022, 16:50

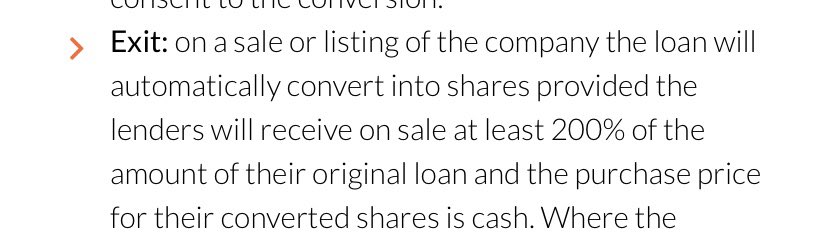

Re: Who do you believe? Thu Jan 27 2022, 16:50The loans are made on a commercial basis. This is the criteria for buying back the shares. pic.twitter.com/6zxBELhUg3

— Philip Shortland (@PhilipShortland) January 27, 2022

Re: Who do you believe? Thu Jan 27 2022, 17:01

Re: Who do you believe? Thu Jan 27 2022, 17:01

Re: Who do you believe? Thu Jan 27 2022, 17:34

Re: Who do you believe? Thu Jan 27 2022, 17:34Cajunboy wrote:But is it smart accountancy and should we be pleased that Sharon & Co have got their hands on the tiller?

Re: Who do you believe? Thu Jan 27 2022, 17:37

Re: Who do you believe? Thu Jan 27 2022, 17:37

Re: Who do you believe? Thu Jan 27 2022, 17:59

Re: Who do you believe? Thu Jan 27 2022, 17:59 Re: Who do you believe? Thu Jan 27 2022, 22:11

Re: Who do you believe? Thu Jan 27 2022, 22:11

Re: Who do you believe? Thu Jan 27 2022, 22:54

Re: Who do you believe? Thu Jan 27 2022, 22:54

It could be, Sluffy, that the whole thing is simply an opportunistic contrivance to take advantage of the circumstances of the COVID pandemic and the lax financial facilities fostered by government to try to keep the economy going and reduce the numbers of business failures.Sluffy wrote:Following on from Phil Shortland's tweet above, it got me thinking about why apparently the government shares are for only 8% of the company which values FV at over £60m?

It could well be something to do with the EFL rule about those owning shares in clubs (plural) of less than 10%.

105 Interests in More Than One Football Club

105.5 The holding of not more than 10 per cent of the share capital of any football club shall be disregarded for the purposes of this Regulation 105 provided that those shares are, in the opinion of the Board, held purely for investment purposes only.

https://www.efl.com/-more/governance/efl-rules--regulations/efl-regulations/section-10-association-and-dual-interests/

Maybe it has all been deliberately contrived so that the two loans totalling £9.5m are shown to be worth £5m worth of shares and that the share value (which obviously isn't a real life one) is set that the governments £5m 'worth' of shares, falls below the EFL's 10% threshold - if the government have loaned to other EFL clubs as well?

Not sure though why there is the 20% discount of what the government paid for their shares - which in theory meant they would have only paid £4m for - but it might explain why £1m worth of shares (117,000) have not been issued - although I can't work the reason out myself if it is actually was the case?

Re: Who do you believe? Thu Jan 27 2022, 23:18

Re: Who do you believe? Thu Jan 27 2022, 23:18BoltonTillIDie wrote:Isles already reported why 8% earlier

https://www.theboltonnews.co.uk/news/19878292.government-future-fund-loan-share-conversion-affect-bolton-wanderers/

Re: Who do you believe? Thu Jan 27 2022, 23:19

Re: Who do you believe? Thu Jan 27 2022, 23:19Sluffy wrote:

Not sure though why there is the 20% discount of what the government paid for their shares - which in theory meant they would have only paid £4m for - but it might explain why £1m worth of shares (117,000) have not been issued - although I can't work the reason out myself if it is actually was the case?

Re: Who do you believe? Thu Jan 27 2022, 23:44

Re: Who do you believe? Thu Jan 27 2022, 23:44Ten Bobsworth wrote:It could be, Sluffy, that the whole thing is simply an opportunistic contrivance to take advantage of the circumstances of the COVID pandemic and the lax financial facilities fostered by government to try to keep the economy going and reduce the numbers of business failures.

There might be other examples in the world of footie but to the best of my knowledge only the owners of BWFC and FGR have gained from COVID loans. FGR more than BWFC as it happens but I don't see anything smart or clever about it and frankly find the whole thing decidedly embarrassing.

The precise details remain hidden despite the legal obligation on FVWL to provide an updated statement of shareholdings. However the numbers that have been provided so far appear to stretch credibility like bubblegum. The £5m loan itself was devoid of any commercial rationale and to exchange it for 8% of the shares, if that is really what has happened, is beyond absurd.

I strongly suspect that Lord Agnew has been spitting feathers for months and the conversion of irrecoverable loans into shares of dubious value has been a shabby tactic to get some of the dodgy loans off the books with the entirely spurious notion that one day the shares might be worth summat.

Re: Who do you believe? Thu Jan 27 2022, 23:46

Re: Who do you believe? Thu Jan 27 2022, 23:46

Re: Who do you believe? Fri Jan 28 2022, 00:02

Re: Who do you believe? Fri Jan 28 2022, 00:02Ten Bobsworth wrote:Its all a contrivance isn't it, Sluffy, but we'll have to wait for FV to provide the details they are legally obliged to provide. They don't seem to be in much of a hurry but lets look at it from another perspective. FV agreed to pay too much for BWFC and took on debts they were never likely to be able to afford to repay and so were stalling as much as they could.

One of those debts was the Eddie Davies Trust. During his lifetime Eddie spent the best part of £200 million on Bolton Wanderers and vast swathes of that money went in taxes on the overpaid footballers and managers of BWFC. However by virtue of taking £5m of taxpayers money effectively as a gift, FV were able to repay half of the remaining debt due to EDT.

Re: Who do you believe? Fri Jan 28 2022, 09:30

Re: Who do you believe? Fri Jan 28 2022, 09:30

Re: Who do you believe? Fri Jan 28 2022, 11:47

Re: Who do you believe? Fri Jan 28 2022, 11:47

Re: Who do you believe? Fri Jan 28 2022, 13:16

Re: Who do you believe? Fri Jan 28 2022, 13:16 Re: Who do you believe? Fri Jan 28 2022, 14:13

Re: Who do you believe? Fri Jan 28 2022, 14:13

Re: Who do you believe? Fri Jan 28 2022, 14:45

Re: Who do you believe? Fri Jan 28 2022, 14:45Ten Bobsworth wrote:This latest piece of business did not take place at the outset of the pandemic but in October 2021, so I'm afraid that the excuses don't wash with me any more than they seemed to do with Lord Agnew, who plainly was spitting feathers at the bank's activities.

Re: Who do you believe? Sat Jan 29 2022, 09:15

Re: Who do you believe? Sat Jan 29 2022, 09:15

Re: Who do you believe? Sat Jan 29 2022, 12:38

Re: Who do you believe? Sat Jan 29 2022, 12:38Permissions in this forum:

You cannot reply to topics in this forum